Una pieza más que resulta necesaria para poder caracterizar el desempeño y dinamismo económicos de cada entidad federativa de México.

Definición:

Se le conoce como índice de penetración de las exportaciones dentro de la economía a la razón de exportaciones a PIB y busca medir, de una forma imperfecta, la importancia que el comercio exterior tiene dentro de cada economía, en este caso, cada entidad federativa de México.

Utilizaremos este indicador para iniciar una aproximación de algunas problemáticas de desarrollo económico y social en las distintas entidades federativas del país. Sin embargo, de partida se advierte que habrá más preguntas que respuestas en este análisis económico parcial con enfoque de comercio exterior.

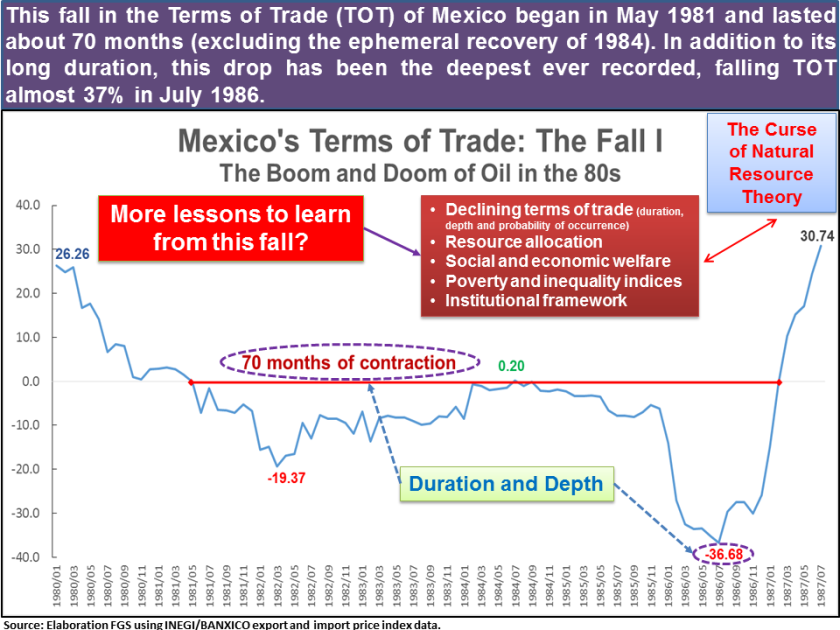

When analyzing the terms-of-trade time series of Mexico, we can easily identify several falls since 1980. However, the longest and deepest contraction ever recorded in modern times is, by far and undoubtedly, the one experienced (and lived) in the 80s, what we have called as The Boom and Doom of Oil.

This sharp decline in terms of trade that lasted about 70 months and was the trigger of multiple social and economic shocks in the 80s[1] must be a reminder for all of us that relying extensively on oil as an economic development lever is a risky business especially if oil is mixed in politics and the economy is facing a weak institutional framework[2].

We might end up in a vicious circle of declining terms of trade, reduced social and economic welfare, higher poverty, and weak and fragile institutions, along with the curse of natural resources and social unrest. Therefore, in order to break up that circle we must work out every part of this equation.

[1] For example, severe fall in GDP per capita for several years, increased in the poverty indicators and social unrest, higher wealth inequality indices, just to mention some.

[2] One of the several explanations of what is called the Curse of Natural Resources Theory.

Algunos antecedentes para análisis

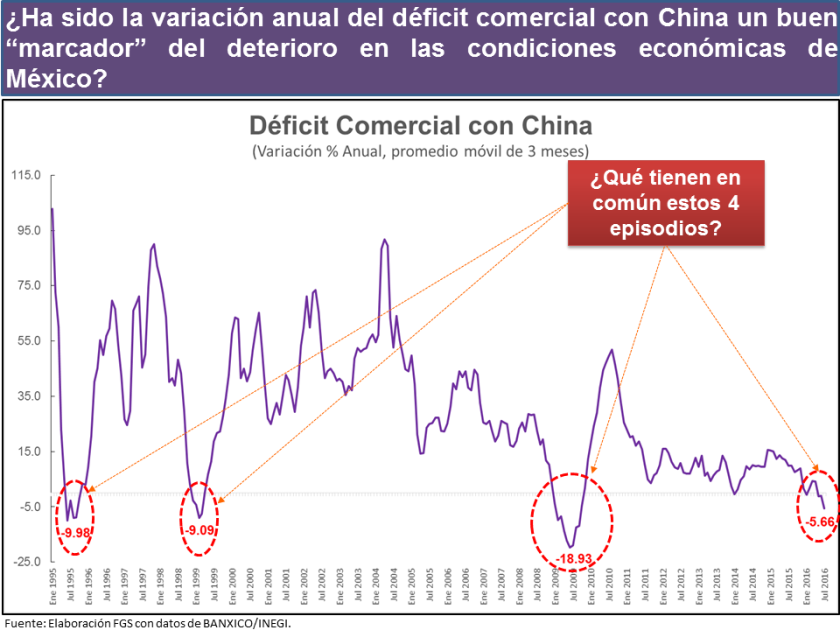

Recientemente, BANXICO/INEGI actualizaron los datos mensuales de exportaciones e importaciones por socios comerciales, llaman la atención los siguientes datos coyunturales para China en julio 2016:

¿Cuándo se han presentado estas condiciones en el comercio exterior de México anteriormente? En 1995, 1998-99, 2009 y 2016.

[1] Esto significa, posterior a la entrada del TLCAN y de la Crisis de la depreciación del peso conocida como el “Error de Diciembre” o “Efecto Tequila”.

[2] Es decir, posterior a la Crisis Financiera de fines de 2008.

In July 2016, the terms of trade (TOT), the ratio of export prices to import prices, of Mexico fell 5.2% in an annual base, continuing its free fall that started in September 2013. Has this most recent decline of TOT been the longest and deepest ever recorded? What have we learned from past experiences?

We will be describing the current shock à la Memento[1], namely, showing the most recent events and then going backwards and zig-zagging some facts.

First, we need to tattoo ourselves some basic information just as Leonard[2] did. In our case, the following chart will be the only piece of information that we’ll have and we must recreate some memories from it.

Factual information:

So, let’s begin recreating some past facts, why are we sailing these waters? In July 2013, the Mexican mixed crude oil price was around $101 dollars per barrel, three years later is quoted in $38.37 (July 2016). This acute Commodity Price Shock in one of the main commodities exported by Mexico, and an important source of foreign exchange and government budget, has brought Mexico’s total trade to a contractionary phase not seen since the Great Recession of 2009 or the 2001 slowdown[3]. This newest contraction in trade could also be called Global Trade Cooling[4] because of its worldwide scope and has been going on since the beginning of 2015 or even earlier for some economies. Let’s call this decline in TOT as Fall IV – The commodity price shock and global trade cooling.

Being an important player of the global economy and an oil price taker, Mexico could not dodge this TOT perfect storm, could it? Is the inevitability of destiny our only path just as it seems to be Leonard’s case?

What if we craft a new tattoo saying “Do not trust oil again” and as Leonard did in Memento go backwards in TOT history to what we have coined as Fall I – The boom and doom of oil in the 80s?

[1] Seminal film and praised by critics created by Christopher Nolan.

[2] Main character in Memento. He suffered from anterograde amnesia.

[3] See: https://fgsaenzfgs.wordpress.com/2016/02/01/grafica-del-dia-caidas-recientes-en-el-comercio-total-de-mexico-addendum/

[4] See: https://fgsaenzfgs.wordpress.com/2016/01/28/2015-enfriamiento-comercial-global/

Debe estar conectado para enviar un comentario.